Q1 a Q2 byly plné otazníků a předpovědi ekonomů se od sebe zásadně odlišovaly. Ekonomickému prostředí vládla nejistota i kvůli omezenému množství informací o viru samotném. To pak znemožňovalo odhadovat kroky jednotlivých vlád a dopad přijatých opatření.

Receivables insurance

The economy is learning to live with COVID

16.10.2020 ARFIN

Not that the situation is dramatically different now. But with the increasing amount of information about the virus infection and also about the reactions of the economies of individual states to the measures taken, the dispersion of analysts’ forecasts is also decreasing. In the current month, two of the major credit insurers have released new studies with economic analyzes and expectations. We used their input for the current economic-analytical article.

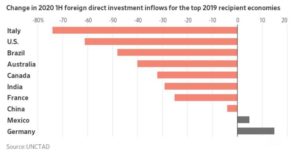

China emerged victorious from the decline in world trade

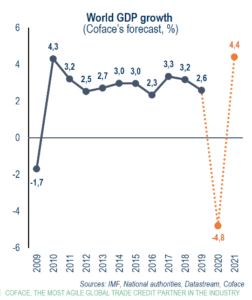

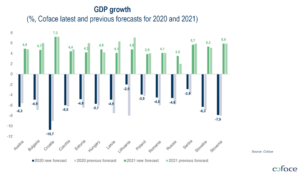

The decline in global GDP in 2020 will ultimately depend on any additional measures taken before the end of the year. However, insurance companies basically agreed that it will move at the level of -4.7 to -4.8%, with the fact that in 2021 part of the losses should be compensated by growth of 4.4 to 4.6%. The current situation has significantly different effects on individual countries and their economies. The expected development is summarized in the attached graphs.

World trade in goods is recovering from the first wave faster than it was during the last economic crisis in 2009. However, it is clear that services have been hit harder in this regard and many sectors still have a question mark over the current development of the measures. Global trade will decline by 13% in 2020, which is 2 percentage points less than the first half forecast. In 2021, on the other hand, trade should grow by 7%.

The current winner in this regard is China. Due to the nature of the centrally controlled regime, the country was able to take swift and drastic measures that would be difficult to enforce in Western-style democracies. This helped bring the virus under control fairly quickly, and today China is running at full speed again (within the scope of other countries as trading partners, of course). China thus increased its share of world trade from 13% before the crisis to the current 27% and is likely to be the only major economy to end 2020 in the black with an expected growth of 1.9%.

However, with the current pandemic situation, the possibility of development according to the W scenario is increasingly being discussed, which would mean a further decline before the economy returns to its pre-crisis state. The probability of such a scenario is roughly 30%.

State support programs – targeted or general solution?

Programs to support the business and civil sectors differ significantly between countries. Today, it is difficult to estimate how exactly it will affect the development of the economy in a given country. There are countries that have prioritized a blanket approach, such as Germany (and in the first wave, the Czech Republic), and countries that try to support companies by address, such as Slovakia. This resulted in the amount of financial resources that were used in individual countries. The correctness of the approach will subsequently affect the level of the increase in unemployment, the number of insolvencies, the country’s total debt and the growth or decline of GDP. It is clear that the current situation has preserved the existing status quo and thus a large number of “zombie companies” survive in the economies of countries. Many questions will be answered in the first half of 2021.

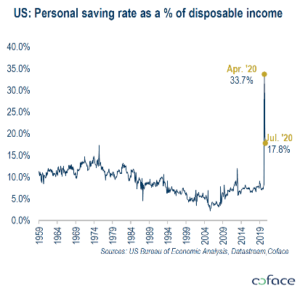

How do companies respond to uncertainty? Higher deposits and lower investments!

At the same time, there is a clearly visible trend towards the accumulation of deposits at the expense of investments. This is mainly due to the huge uncertainty about future developments. Companies thus postpone their investment plans to the more distant future. But not only you. The same approach is evident in the population as well, as seen in the following graph of the personal deposits of US residents.

“Preserved” insolvency

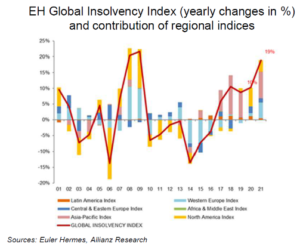

Current developments should clearly have a negative effect on the increase in insolvencies. However, as we have already mentioned, the support measures of individual governments, together with changes in the legislation of countries introducing a new or simplified form of protection against creditors, caused the number of insolvencies to decrease by 6% worldwide. We observe a similar scenario in the case of Slovakia and the Czech Republic. However, when comparing the years 2021 and 2019, the expectations of insurance companies do not change. There should be more than a 30% increase.

Some sectors will cope with the consequences of the crisis until 2023

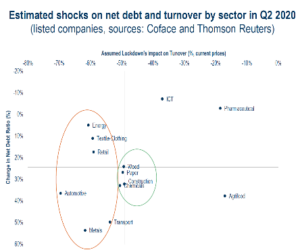

There are industries that were only minimally affected by the crisis. In some cases, industries even grew during the crisis. This is mainly about agriculture and the pharmaceutical industry. The IT, chemical industry and construction industries should also deal with the crisis relatively well and quickly. On the contrary, the automotive sector, whose problems started before the crisis, metallurgy, the energy and textile industries, air transport and retail, with the exception of food, are significantly affected. The graph from EH shows the estimated length of recovery, and the graph from Coface shows the impact on the turnover and indebtedness of individual sectors.

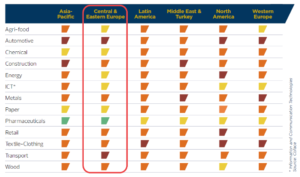

We also add an overall overview of the current assessment of the industry in individual regions from Coface: